This deception was smart, no expenses were spared in this elaborate scheme to cash in on the growing Crypto market.

Fraud has always existed but methods are kept quiet and the scammers don’t want to draw attention to themselves.

But in relation to this scam it was their mission to cause as much hype in a short space of time and generate enough interest to successfully pull it off.

They showed on socials their fake offices and staff and got fake “crypto eats ” drivers to wear uniform for the company that never existed.

A elaborate launch party with celebrities and in London promoting the new company and what was described by Globenewswire as “the next big thing” in food delivery called “CryptoeatsUK”

Since publishing this article and my YouTube video they have deleted the article from the website.

Luckily i screen recorded it.

Globenewswire

Rug pull

Sadly for the investors the website for Crypto eats doesn’t exist anymore because the company folded overnight after scamming people for half a million pound.

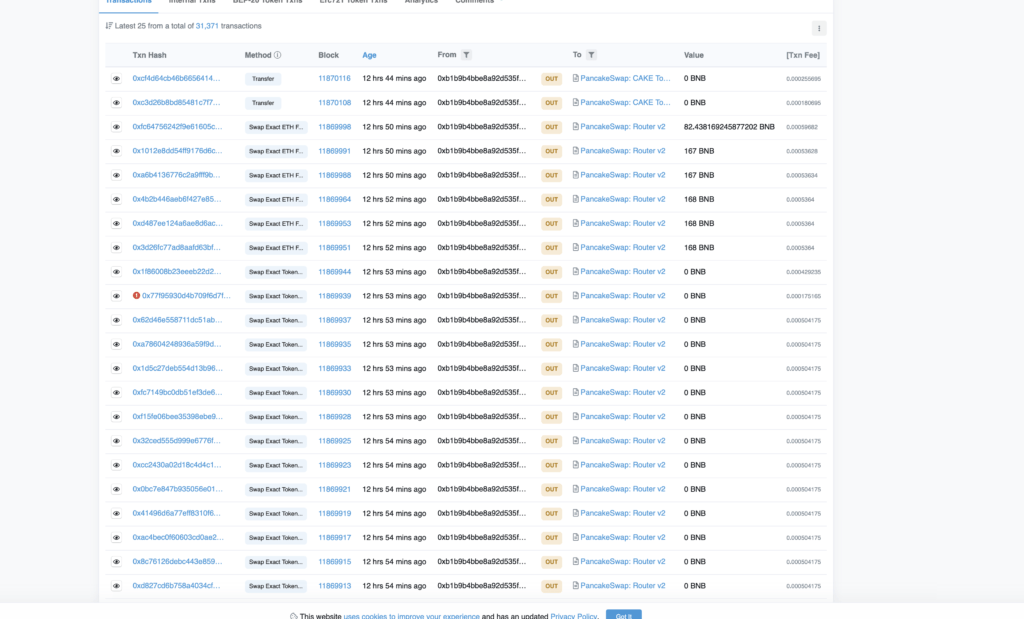

I was able to locate the wallet that holds 95% of the liquidity

And the worst part about these is that nobody will be arrested or convicted because it’s done in unregulated cryptocurrency.

And there is no protection against this happening.

So basically 1000s of people trusted a company that was promoted by various influences, and invested their hard earned money and have now been ripped off and the company what they would call in the industry a rug pull.

I’m going to explain exactly what happened and exactly what where the money’s gone to how I know how much money was taken as well, because as I keep telling people, cryptocurrency is not hidden.

You can trace everything.

I have aslo learnt what has really upset a lot of people online in the past day is the fact that celebrities such as DJ Charlie Sloth, who has a million followers, and also Bouncer who managed music artists and has a lot of younger followers promoted this company, on the basis that they were going to rival Uber Eats.

This company never existed, like this company application, it was never going to be launched.

They even faked that they had offices with “Crypto Eats” on the banners and went to great lengths in order to make people believe that this was genuine.

Investors are angry and in response to the influencers that have participated in the promotion of the company like “Bouncer” from “Play dirty.” have said.

Bouncer statement

“Oh my god, crypto eat coin turned out to be a big scam.

They paid me to do a promo for the food application, not the coin, and he got invited to an event and they all had delivery bikes outside.

He said I didn’t make no videos telling people to buy crypto, I made a video saying an app is being made on Monday, the 18th of October, though, that is the day the application was going live. “

The crypto coin went live on the 17th.

So they got everybody to invest and buy the coin, which they pumped and then all of the liquidity was taken by one wallet, some blog sites are now starting to say that it was 8 million pounds.

That is the market cap.

And that is totally different to liquidity.

Charlie Sloth

The other influencer that spoke out about this was Charlie Sloth

He said, “as far as I’m aware, crypto eats was a new food delivery service that was going to rival Uber and deliver room me and my team are commonly investigating, and we’ll share what we discover. “

But Charlie, I’m one step ahead of you.

I’ve done all the investigating that you need.

Globenewswire.com

With what was merely a quick Google search, I was able to find a “Global News Wire” article on this new app that was about to launch.

So I’m going to read this article to break down exactly what it was trying to promote, and also what was going on as well.

And to start with, it’s an absolute shambles.

Like there’s so many mistakes in his article there, it’s actually painful to read.

And they’ve also got a stock image of Binance widely circulated on Crypto sites on Twitter, that this stock image they used as the owner of the company was actually just from stock, like this person doesn’t exist… Wade Phillips doesn’t exist.

And this is something that Charlie’s Sloths team could have found out with a quick Google search, which you should do if you’re going to promote a business that you expect your followers to invest in.

And also don’t forget Globe Newswire has already been held responsible for influencing different markets in relation to ‘Litecoin” this year.

They previously said an article earlier this year that they deleted that said Litecoin would be getting accepted in different shops around the world.

Now a few months later, they’re endorsing another “Crypto company.”

So I’m not sure what’s going on with global Newswire, who is owned by a conglomerate company.

The company owns dozens of different digital publications.

And this is the danger with the news nowadays is that you don’t even know who’s giving you the news, or who is in control of the narrative.

Red flags

The article says that after a successful 8 million pounds series a funding secured in 2020.

They also say that it’s going to take a large slice of the 16 point 6 billion delivery app market.

The first line of that 8 million in funding series a funding.

This is unprovable we have no idea where he’s funding came from that probably would have involved a nondisclosure agreement.

And the only reason you can trust that is if you trust the person who is associated to the company.

And that is why they was marketing Wade Phillips, who doesn’t exist as the owner.

He goes on to say that Crypto Eats is the first step in allowing people to use cryptocurrency as a form of payment for items in the real world.

It has bridged the gap and found a way for usability cryptocurrency with this use factor, the answer is more fascinating than its humble beginnings imply.

And they also go on to say that the series A investors which don’t exist, because nobody invested in this company, and not allowed to salad until 2025.

And that is also not true, the token wallet was unlocked.

I’ll explain that in a minute.

They also give themselves a prediction of a market increase of 20% in the first year, and emerging as the main contender and funding to have become the leader in the cryptocurrency food delivery market.

They then go on to say the eats have announced over 100,000 people have signed up to their website to download the app on the first day.

And that isn’t true because the application never existed.

It was never launched.

They said they’ve done successful beta testing of the application that didn’t exist in and around London, and franchises like Nando’s or McDonald’s took part.

That just didn’t happen.

They then go on to say they had 1000 private users to test the app to make sure there was nothing wrong with a customer service bugs, etc. etc. etc. blardy blardy blar.

And then the last paragraph has no punctuation and they also spelt deliveroo wrong.

And bear in mind, this is on a website that is technically used to be a big news company.

And the only contact name is Sam.

And Sammy turns out is Sam Bolton.

Promo team

Sam is from the fake promotion team that contacted the influencers.

And I’m very confident Sam doesn’t exist either.

And they also misspell crypto eats as well, the website which again doesn’t exist anymore.

So straight away from that one search of the application, you can see that this company looks pretty ridiculous.

And then if we go to look at the actual Crypto token, so “Crypto EATS” token was simply called “eats”

This happened in about one day, they managed to create these tokens as you can go back to see when the token was created via the chain.

So what I did was I went on to Poo coin, which is a way to find out how good your coin is.

And to find out any problems that you may have with this company or to see if it’s a rug pull.

So a rug pull is when the company is going to rip you off.

And the liquidity that will be put into it will be taken out as soon as and automatically a red flag on this poo coin analysis of Eats is the fact that the wallet is unlocked.

An unlocked wallet simply means that the creator of the coin can take the money as soon as they want, they can remove that money from the wallet whenever they feel like it, which is known as a rock pool. So they can take all of the money invested into the coin which is pumped up and up and up.

And then simply just take it and there’s nothing anyone can do because it’s not a regulated company.

That’s why it’s so important to get people like influences involved because they are the ones that are going to be responsible for driving people over the traffic.

And a lot of people went over to buy these coins and you can actually see the last moments of this company.

Of course it happens, you can invest in a coin and it can do well.

But at the same time there is no protection.

Some people are saying that maybe pancake swap can freeze this one eats and stop the money from being transferred.

But as it is right now there is absolutely no coverage on the story.

No mainstream media knows it’s happened.

Nobody cares about it.

And I care because I know that it’s just normal people that are investing in this people that come from counsel the stage probably works really hard and they’re just trying to make a little bit of money.

So at the same time a criminal is going to be a criminal but for an influencer to take part in this and to endorse it for me is where it really becomes a problem.

So I think that every single one of these people that took a payment for this should donate it to charity.

I really want to hear what people have to say and of course contribute any extra context or any information you have to make people aware of the risks that they’re taking when they get involved in things like this.

What are cryptocurrencies?

Cryptocurrencies are also known as crypto coins, digital currency and cryptoassets. Examples include Bitcoin, Ethereum and Litecoin.

The ‘crypto’ part of the word ‘cryptocurrency’ means ‘hidden’ or ‘secret’. This refers to the secure nature of cryptocurrency – it’s nearly impossible to forge or track, due to the way it is created. However, that doesn’t stop it from being a risky investment.

Are cryptocurrencies safe?

The Financial Conduct Authority (FCA) sees cryptocurrencies as speculative, very high-risk investments. So, if you invest in cryptocurrencies, you could easily lose all your money.

The FCA has also issued warnings about the risk of investing in contracts for difference (CFDs) that have cryptocurrencies as the underlying asset, and it is currently considering banning the sale of these products to retail customers.

In October 2020, the FCA banned the sale of derivatives and exchange-traded notes (ETNs) to retail consumers that reference certain types of cryptoassets.

Are cryptocurrencies regulated?

It depends on the type. Exchange tokens such as Bitcoin and other cryptocurrencies (see below) are only regulated in the UK for money laundering purposes. If you buy these types of cryptoassets, it’s unlikely FSCS would be able to protect you if something went wrong.

Some types of cryptoassets may be regulated, depending on how they are structured. For example, the FCA does regulate security tokens. They include tokens that provide rights, including:

- Ownership position.

- Repayment of a specific sum of money.

- Entitlement to a share in future profits.

Cryptocurrency risks

If you’re thinking of investing, you should get independent financial advice about the risks involved. Here are some of the risks to consider:

- Volatile value. Cryptocurrency market value can be extremely volatile. You could lose a lot, very quickly.

- Hard to spend. You can’t necessarily spend cryptocurrencies like cash. Very few sellers will accept cryptocurrency as payment. So, generally you’d have to sell them in exchange for traditional currency.

- Intangible. Cryptocurrencies are intangible – they only exist in a digital peer-to-peer network.

- Unregulated. Cryptocurrencies are often unregulated. So, if your funds are stolen, there isn’t an easy way to get your money back.

- Unprotected. Cryptocurrencies often aren’t protected by organisations like the FCA or FSCS (more on this below). It can be difficult to work out what type of financial product they are, and whether they’re regulated.

Please don’t forget to Like comment, share and subscribe.

Peace.